Introduction

Ever wondered where you could stash your cash without committing to it for the long haul? Well, that’s where money market accounts (MMAs) step in! They act as a savior for your savings, providing a spot to keep your funds and even earn some interest. In this blog entry, we’ll explore the realm of MMAs, detailing their operations and why they could be what you need for your financial goals.

Table of Contents

What is a Money Market Account?

A money market account is like a savings account but with interest rates. It also allows you to write checks or use a debit card, making it a mix of checking and savings accounts for the best of both worlds.

How do Money Market Accounts Work?

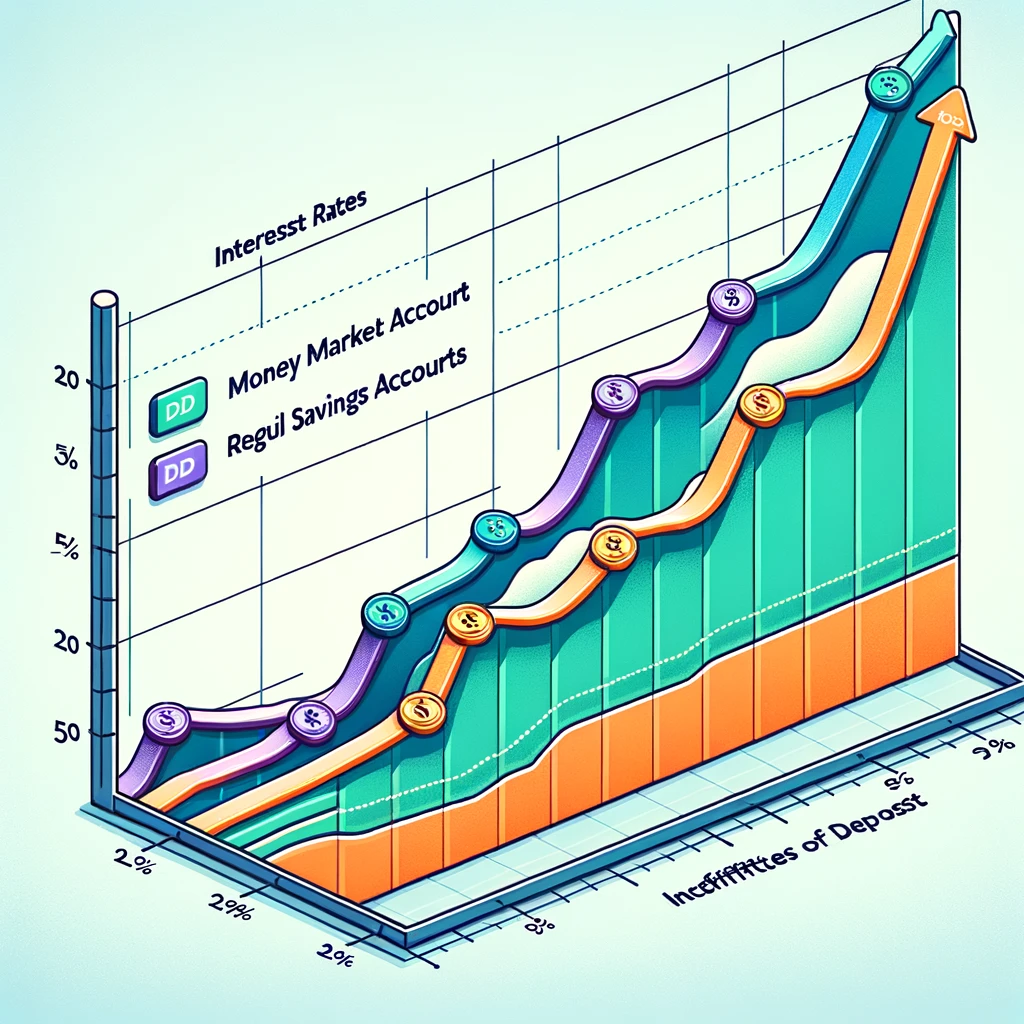

Money market accounts function by investing savings in long-term, low-risk assets such as Treasury bills and commercial paper. The interest you receive is determined by these investments, which is why MMAs typically provide higher rates than standard savings accounts. However, the downside is that they generally necessitate a balance for account opening and upkeep.

Key Features of Money Market Accounts

Money market accounts function by investing savings in long-term, low-risk assets such as Treasury bills and commercial paper. The interest you receive is determined by these investments, which is why MMAs typically provide higher rates than standard savings accounts. However, the downside is that they generally necessitate a balance for account opening and upkeep.

Pros and Cons of Money Market Accounts

Pros:

- Higher interest rates mean more earnings on your savings.

- Easy access to your funds through checks or a debit card.

- They are insured by the FDIC or NCUA, providing peace of mind.

Cons:

- Higher minimum balance requirements can be a barrier for some.

- Interest rates can vary, so it’s essential to shop around.

- There are limited monthly transactions so that it could be better for frequent withdrawals.

How to Choose the Right Money Market Account

When choosing an MMA, consider the following:

- Consider seeking out interest rates to make the most of your earnings.

- Make sure you can quickly meet the balance requirements without any strain.

- Be cautious of any maintenance fees or additional charges that may apply.

- Ensure you have access to your funds whenever

- Verify that the FDIC or NCUA insurance backs the account.

Investment Strategy

Investment Diversification: Money market accounts (MMAs) provide an opportunity to diversify your investment portfolio, presenting a low-risk alternative in conjunction with investment options.

Immediate Financial Goals

Interest Rate Environment

Remember that the interest rates for MMAs can vary and may fluctuate based on market conditions. Let’s compare rates from various financial institutions to ensure you get the most favorable deal.

Account Limitations

Limits on Transactions: Money market accounts often have restrictions on the number of transactions allowed per month, so make sure you’re aware of these limits to prevent incurring any fees.

Penalties for Withdrawals: Certain accounts may impose penalties for making withdrawals, so it’s important to familiarize yourself with your account’s terms and conditions.

Tax Implications

Income from Interests: Remember that the interest you make on a money market account is subject to taxes, so it’s important to factor in the tax consequences when figuring out your profits.

Security and Safety

When handling your MMA online, ensure the financial institution you’re using has security measures to safeguard your account. Opt for a trusted institution to ensure your money is secure.

Customer Service

Ensure that you have access to customer support for any inquiries or concerns regarding your account. Seek out institutions known for their top-notch customer service to guarantee an experience.

Conclusion

Money market accounts are an option for individuals seeking interest rates while maintaining access to their money. They can be an asset in managing your finances, offering an adaptable method to increase your savings. Why take the opportunity to enhance your funds by exploring the possibility of opening a money market account today?

Frequently Asked Questions (FAQs) about Money Market Accounts

What is the difference between a money market account and a savings account?

- The main difference is that MMAs typically offer higher interest rates and the ability to write checks or use a debit card. In comparison, traditional savings accounts usually have lower interest rates and limited access to funds.

Are money market accounts safe?

- Yes, MMAs are considered safe investments as they are insured up to $250,000 by the FDIC or NCUA, protecting your money in case the bank or credit union fails.

Can I lose money in a money market account?

- It’s unlikely, as MMAs invest in low-risk securities. However, it’s important to note that the interest rate can fluctuate, which may affect your earnings.

How often do interest rates on money market accounts change?

- Interest rates on MMAs can change at any time based on market conditions and the financial institution’s policies. It’s a good idea to check the rates your bank or credit union offers regularly.

Are there any fees associated with money market accounts?

- Some MMAs may have monthly maintenance fees or require a minimum balance to avoid fees. Be sure to read the account terms and conditions carefully to understand any potential charges.

How many withdrawals can I make from a money market account?

- Federal regulations typically allow up to six monthly withdrawals or transfers from an MMA. However, some institutions may offer more flexibility, so it’s essential to check with your bank or credit union.

Is a money market account the same as a money market fund?

- No, they are different. A money market account is a deposit account offered by banks and credit unions, while a money market fund is a type of mutual fund that invests in short-term debt securities.